Is Tether a black swan?

A risk assessment by a DeFi security guy. Note: I’ve been working as a security auditor and engineer in the blockchain space for four years and participated in audits of DeFi protocols such as Aave, Bancor and mStable which also involved assessing economic risk. Consider this a complementary Tether risk assessment that Tether didn’t ask for.

This article reflects my personal opinion and I’ve been known to be wrong at times. Let me know in the comments if you spot any glaring errors.

Tether’s USDT stable coin has experienced massive growth since the start of the ongoing bull cycle. There’s now an order of magnitude more USDT in circulation than during the height of the 2017–2018 cycle. This makes it worth re-investigating whether the crypto markets are robust against a potential Tether-related liquidity shock.

In this article I attempt to address the following questions:

- How would a loss of confidence in Tether play out in the short term?

- Who would get most rekt if a Tether-related crash happens?

- Would a Tether confidence crisis be a black swan event* that would severely impact the market?

* For the purpose of this article, we use “black swan” to refer to a massive event that would surprise most people. After all, 95% of people in the crypto space insist that Tether is fine. If you’re unhappy with that definition feel free to think of it as a white swan event.

“What may be a black swan surprise for a turkey is not a black swan surprise to its butcher.”

— Nassim Nicholas Taleb

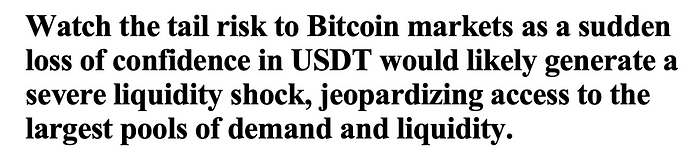

1. The shape of US dollar liquidity in the crypto markets

In 2018, Hasu found that USDT made up for 29% of Bitcoin’s liquidity. Since then, the situation has become a lot more complicated. Not only is there 12x as much USDT in circulation. USDT trading pairs dominate spot markets on centralized exchanges (CEX) where they account for roughly 65% of trading volume. Furthermore, the complexity of the market has increased significantly due to the proliferation of crypto-related TradFi products, DeFi protocols and USDT-collateralized derivatives. That said, this analysis focuses on CEX and DeFi markets which would get directly impacted by a Tether shock.

The stable coin landscape

As of June 17th, 2021, USD stable coins have an aggregate market cap of $106.2 billion and USDT has a 61% share of that pie.

The supply chart doesn’t tell the whole story though as different stable coins fulfill different roles in the market. To get the full picture we need to know more about the structure of fiat/stable coin liquidity.

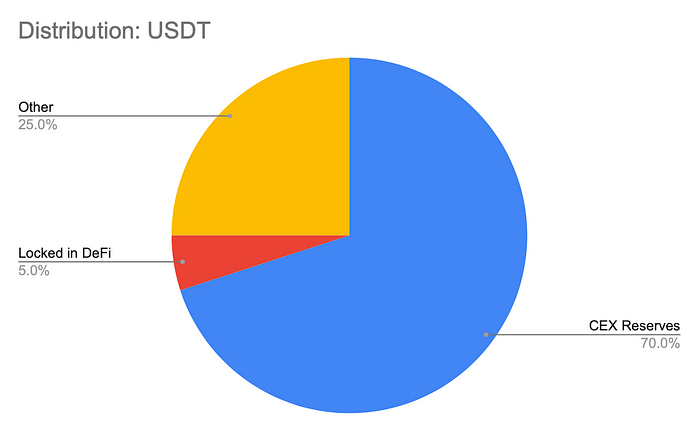

CryptoQuant tracks $7.25B USDT in exchange USDT reserves. However, this doesn’t count USDT on the Tron blockchain which accounts for half of the USDT supply. According to Tether’s rich list, 17 billion Tron USDT are held by Binance alone. Almost 20B USDT are held by the top two exchanges. Given those numbers, the total value given by CryptoQuant appears understated. A more realistic estimate is that ~70% of the Tether supply (43.7B USDT) is located on centralized exchanges.

Interestingly, only a small fraction of those USDT appears in spot order books. One likely reason is that much of it is used to collateralize derivative positions such as perpetual futures. The massive futures market generated $60 billion in volume over the last 24 hours on Binance alone. It’s important to understand that USDT perpetual futures implementations are 100% USDT-based, including collateralization, funding and settlement. Prices are tied to crypto asset prices via clever incentives, but in reality, USDT is the only asset that ever changes hands between traders. This use-case generates significant demand for USDT .

With regards to DeFi, 2.19% of the USDT supply is locked in smart contracts according to Glassnode. Again, the real number is likely higher since Glassnode can’t possibly track all DeFi protocols across all blockchains. We’ll assume a value of ~5% which seems to be compatible with the numbers shown by major Ethereum DeFi protocols: Cumulative USDT liquidity on Aave, Compound and Uniswap is $1.73B.

The rest of the pack

The market perceives USDT differently from other stable coins. This distinction is sometimes made explicit at exchanges. For example, FTX considers USD, USDC, and BUSD to be equivalent while USDT is treated as a separate asset.

With that in mind, let’s look at the distribution of USDC and BUSD, the second and third largest stable coins. According to CryptoQuant there’s a total of 1.59B USDC and 5.02B BUSD in exchange reserves, or 6.7% and 52% of the supply, respectively (as with USDT, the real numbers are probably somewhat higher than reported by CryptoQuant, although USDC and BUSD are issued on fewer blockchains and should be easier to track).

Besides the fact that the share of USDC supply held by centralized exchanges is relatively small, I found it notable that liquidity in USDC/USDT and BUSD/USDT order books on offshore exchanges is generally thin on the sell side, i.e. there’s not a lot of liquidity available to USDT holders who want to cash out into safer stable coins.

Let’s look at DeFi stats. Glassnode reports that 17.22% of the USDC supply is locked up in smart contracts. Again, Glassnode only considers data from the Ethereum blockchain, but USDC is used on other DeFi chains too, including a pegged version of USDC on Binance Smart Chain with a 1.8B supply. USDC liquidity on Aave, Compound, and Uniswap adds up to 8.14B, or 4.7x higher than USDT. Given those numbers, it seems reasonable to assume that at least 25% of USDC is located in DeFi smart contract accounts.

At 0.55%, the percentage of BUSD locked in smart contracts looks much lower but again data from Binance Smart Chain is missing here. There’s 768m BUSD locked in PancakeSwap and 2.26B available for borrowing on cream.finance, showing that BUSD is heavily used on Binance Smart Chain. 30% of BUSD supply in smart contracts sounds like a reasonable estimate.

Fiat liquidity

Ties between the cryptocurrency markets and the “legacy” fiat world have always been shaky. Just recently, Binance lost its USD banking partner. Consequently, fiat trading is only available on a subset of exchanges.

Looking into USDT/USD, BTC/USD, and ETH/USD order books on Bitfinex, Coinbase, Binance US, Kraken, FTX, and Gemini, which represent 60% of the fiat exchange market share, I found a total of $203m in bids within -2% depth. Note that I didn’t account for EUR and KRW, plus there might be buyers looking to pick up cryptocurrencies at a discount in the event of a USDT crash. Total fiat liquidity bidding on crypto on fiat exchanges is likely somewhere in the low ten digits.

How much fiat liquidity is there in the market overall? It’s hard to tell. Perhaps institutions are queueing up at OTC desks with billions of US dollars, ready to buy the dip (though recent outflows from digital asset funds suggest otherwise). The waters are further muddied by the fact that institutional investors can get exposure to crypto via instruments on regulated markets such as Grayscale Trust Shares, MicroStrategy stock, Crypto ETFs, and CME Futures. The Coinshares Weekly Digital Asset Fund Flow report provides some insight into those markets. But I think it’s safe to say that “real” fiat liquidity plays a relatively small role in the cryptocurrency spot markets which is where most of the action during a USDT sell-off would take place.

Analysis

There are some salient differences between stable coin distributions. Notably, a larger share of the USDT supply is located on centralized exchanges. USDT is by far the most liquid stable coin in the CEX world and is essential to cross-exchange market makers. It also serves as a “casino chip” that grants entry into the perpetual futures market. On the other hand, USDT is largely shunned by DeFi protocols and gets less usage in that area.

Conversely, USDC serves as the stand-in for USD in DeFi and as a safe haven asset, with a large chunk of the supply locked in smart contracts and sitting in blockchain wallets (this certainly matches my personal trading experience: Intuitively, the safest way to store value in crypto is holding USDC on a Ledger). BUSD is a mix of both: A good chunk of the BUSD supply is being used in spot trading and to collateralize perpetual futures on Binance, but it also gets significant usage as a “DeFi dollar” on Binance Smart Chain.

As we have seen, if USDT holders on centralized exchanges chose to run for the exits, USD/USDC/BUSD liquidity immediately available to them would be relatively small. ~44 billion USDT held on exchanges would be matched with perhaps ~10 billion in fiat currency and USDC/BUSD (not accounting for the fact that liquidity providers would flee the market during a panic — more on this later).

Mechanics of the Tether peg

The main reason why USDT price could conceivably collapse is that the majority of USDT holders can’t directly “run to the bank”. According to itself, Tether only does business with “professional investors”. Retail traders can only sell their USDT in the CEX spot markets and DeFi markets, either for other crypto assets, stable coins, or fiat. As the March 2020 “COVID crash” has shown, traders will mostly buy stable coins and fiat in times of uncertainty. And we already know there’s not a lot of liquidity available for doing so.

Why Tether’s peg is fragile

To fully understand why the price of USDT might collapse under pressure, let’s first look at how the peg is normally maintained. Demand for USDT is driven by its usefulness in the CEX world. In times of high demand, the USDT peg breaks upwards which creates an arbitrage opportunity where traders can purchase freshly minted USDT from Tether at $1 and buy crypto or USD at a discount.

When the peg breaks downwards, this also creates an arbitrage opportunity where traders can purchase USDT at a cheaper price, thus helping restore the peg (detailed analysis by Frances Coppola).

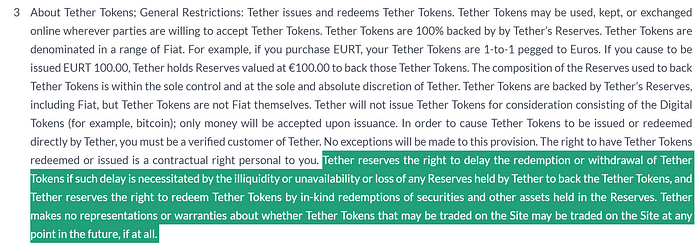

Under normal circumstances, even if USDT price fell below $1 for a prolonged period, arbitrageurs* should eventually buy the discounted USDT and restore the peg. Crucially, this requires trust in Tether: The arbitrageur must have confidence that the USDT can eventually be redeemed at par, or at least above the purchase price. The problem is that this isn’t guaranteed according to Tether’s TOS and Tether isn’t exactly known for its competent, fiscally responsible management style. Thus, it’s riskier for arbitrageurs to help maintain the peg in times of strong sell pressure.

Note that strong sell pressure on USDT can occur whether or not Tether is actually solvent. In the short run, it only matters what the market believes. History has shown that Tether-like funds can melt down due to unpredictable trigger events. This could be any event that widely damages confidence into Tether — like a crackdown by authorities, a bombshell revelation from ongoing regulations or a random flash crash in the price of USDT.

Large arbitrageurs who are no longer confident in Tether’s solvency can simply withdraw their bids and let USDT and crypto holders pick up the bill.

* Update November 2021: Research from Protos shows that two big market markets were responsible for 2/3 of USDT issuance requests. Essentially, the market relies on these market makers to maintain the peg during prolonged sell pressure.

3. “This is good for Bitcoin”

We have seen that there’s plenty of real fiat money and stable coins in the system. So after all, even if USDT crashes overnight, how bad can it be? Won’t USDT just be flushed out and all that value move into other assets like Bitcoin? Well, let’s think this through.

The idea that value would “move from USDT into other assets” if Tether suddenly becomes worthless is based on a fundamental misunderstanding of how markets work, as well as the important role that fiat liquidity plays in its operations.

When liquidity evaporates

Imagine what would immediately happen if half of all US dollars in the real world would be declared fake. As Bitcoiners remind us at least 1,000 times per day, price is a function of scarcity. Naively, if US dollars suddenly become twice as scarce they’d also become twice as valuable. In other words, people who own dollars could buy everything twice as cheaply (the wonders of deflation!).

Now, let’s imagine an idealized toy version of the cryptocurrency market. Only two assets trade in this market: Crypto tokens and USD tokens. In this model, all crypto tokens are interchangeable as their USD prices correlate heavily (this is pretty close to what happens in the real markets). DeFi bros may instead imagine a constant product AMM with all crypto tokens (BTC, ETH,…) in reserve 1 & all USD-pegged tokens in reserve 2.

Let’s plug some numbers from the first section of this article into our toy market. We start out with a balanced market. Now, all of a sudden, 57.8% of the USD token supply (equaling Tether’s share of total USD liquidity in the crypto markets) are found to be worthless. Holders of the now-worthless fake USD tokens would dump those tokens into the market, including for “real” USD tokens, driving up the premium on those tokens. Since “real” USD-pegged tokens are now 57.8% more scarce they should eventually trade at a 136% premium (only within the toy market! They’re still worth $1 in the real world).

That’s not all though. In the above scenario, all crypto asset prices would dump rapidly (since fiat equivalents are now trading at a premium), causing many hodlers, liquidity providers and market makers to panic and attempt to exit into safe fiat liquidity. Yields on USDC and BUSD in DeFi pools would shoot up to unseen amounts as users try to exit into safety. Centralized exchanges would face a run on fiat deposits. We would be looking at a situation where USD-equivalents practically become unavailable. But USD tokens are required to guarantee the basic functions of the market: Market making, arbitrage, loan repayments, and so on. Without them, the market freezes.

There would be no way for trading to continue. Price feeds like Coingecko, which conflate USDT and USD prices, would no longer work reliably.

Of course, the dynamics of the real market are vastly complex. But the bottom line is: If all USDT were found to be worthless tomorrow, the fiat prices of all crypto assets would dump and the market would experience a liquidity shock as most fiat liquidity vanishes. It would then need to be “rebooted” in a Tether-less state, likely at much lower fiat valuations.

While there’s a chance that large players would counteract a crisis by buying back large amounts of USDT to restore the peg, or by successfully reassuring the market that all USDT can be redeemed at par, there’s no way to be sure that this will happen, unless you put a whole lot of trust in Tether and its affiliates.

4. How USDT issuance works

We have seen that it’s important that the market keeps confidence in Tether. The second question is how much Tether’s reserves would actually be worth in the event of a severe downturn of the cryptocurrency markets.

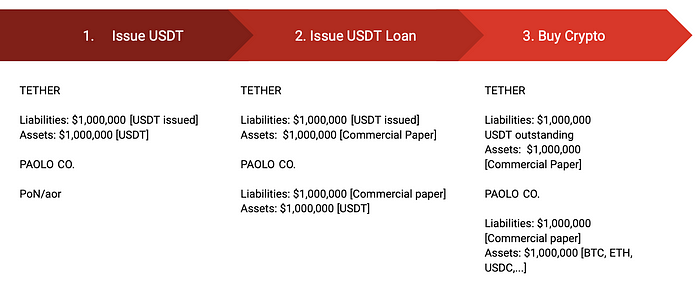

It is usually implied that USD inflow into Tether’s bank accounts matches the supply of USDT 1:1. But if you look at Tether’s reserves breakdown, specifically the large position in “commercial paper”, it’s easily possible that Tether could be issued in the form of USDT-denominated loans, similar to how fiat money is created by commercial banks in TradFi.

Now, I don’t doubt that some investors have minted and redeemed USDT for USD (there’s anecdotal evidence that they have), but given Tether’s history of banking problems and legal issues, I find it hard to believe that institutional investors have literally transferred 62.7B US dollars to Tether. To me, it seems more plausible that some form of leverage is involved.

The issuance process might work as follows. Imagine a fantasy company named “Paolo Co.” which is a subsidiary of, say, “Delta Bank”, co-owned by Tether executives (just like Tether and Bitfinex turned out to have the same owners). Tether purchases commercial paper from Paolo Co. using newly minted USDT. Paolo Co. then invests the borrowed USDT in the crypto markets. The commercial paper goes into Tether’s reserves. This would result in all USDT being “100% backed by reserves”, plus it would make Tether’s reserve basket look like a money market fund which would put most minds in the crypto world at rest.

Note that this is just one possible implementation — there are numerous ways how Tether could use loans to affiliates or shell companies to create USDT out of thin air.

In any case, we should demand evidence of proper backing from Tether and assume the worst when that evidence is not provided. Not the other way round!

Update Oct 9th, 2021: Bloomberg’s Tether investigation shows that Tether has indeed issued USDT loans to its partners. This was later confirmed by the CEO of Celsius network.

Keep in mind that just like TradFi, the crypto markets are a game where everybody’s goal is to maximize profits. Tether operates in an opaque corner of an unregulated market where people tend to believe anything it says, so it has a lot of leeway for bending the rules. And Tether has repeatedly been caught lying. In the words of the New York Attorney General:

5. The casino always wins

The question remains, why would Tether and exchanges potentially put the whole market at risk?

Moral hazard is a well-known cause of financial crises in the TradFi markets: Banks always profit during bull runs but are bailed out by taxpayers when the markets crash, so they have little incentive to act responsibly. Presumably, this is even worse in unregulated markets due to the lack of oversight and accountability.

Part of the problem is that the fat-tail risk is largely being transferred to USDT holders. Neither Tether nor centralized exchanges are liable for redeeming USDT at par. Therefore, if a USDT de-peg does occur, hodlers of USDT and cryptocurrencies would be first to take a haircut as their assets get devalued. Knock-on effects could send exchanges into bankruptcy as well, but at least they’d be in a much better place than retail traders. There have been multiple occasions where holders shared the losses while exchanges continued operations.

6. Conclusion

In my opinion, a Tether confidence crisis would likely result in a massive shock to the market followed by a significant re-pricing of all crypto-assets.

Tether’s loan-based issuance mechanism creates hidden leverage at the base layer of the crypto markets. The fact that most actors in the market don’t acknowledge the risk, and at times go out of their way to defend Tether instead of holding it properly accountable, speaks to the immaturity of the market and its inability to self-regulate.

Whatever you think of the crypto space fundamentally, crypto assets can’t become viable long-term investments as long as Tether remains systemically important. Getting rid of USDT — black swan or not — will result in a more mature and robust market in the long run.

One can be long-term bullish on the value proposition of decentralized finance and still view the market as a casino. It’s not incompatible.

I’d like to thank Frances Coppola, Gerhard Wagner, and some other contributors who wish to remain anonymous.

7. Data Sources

The data used in this article was gathered from the following websites between June 14th and June 17th, 2021: